What’s the difference between a hurricane and an insurance provider? One’s supposed to leave you in better shape than it found you. But are today’s insurers truly living up to that promise?

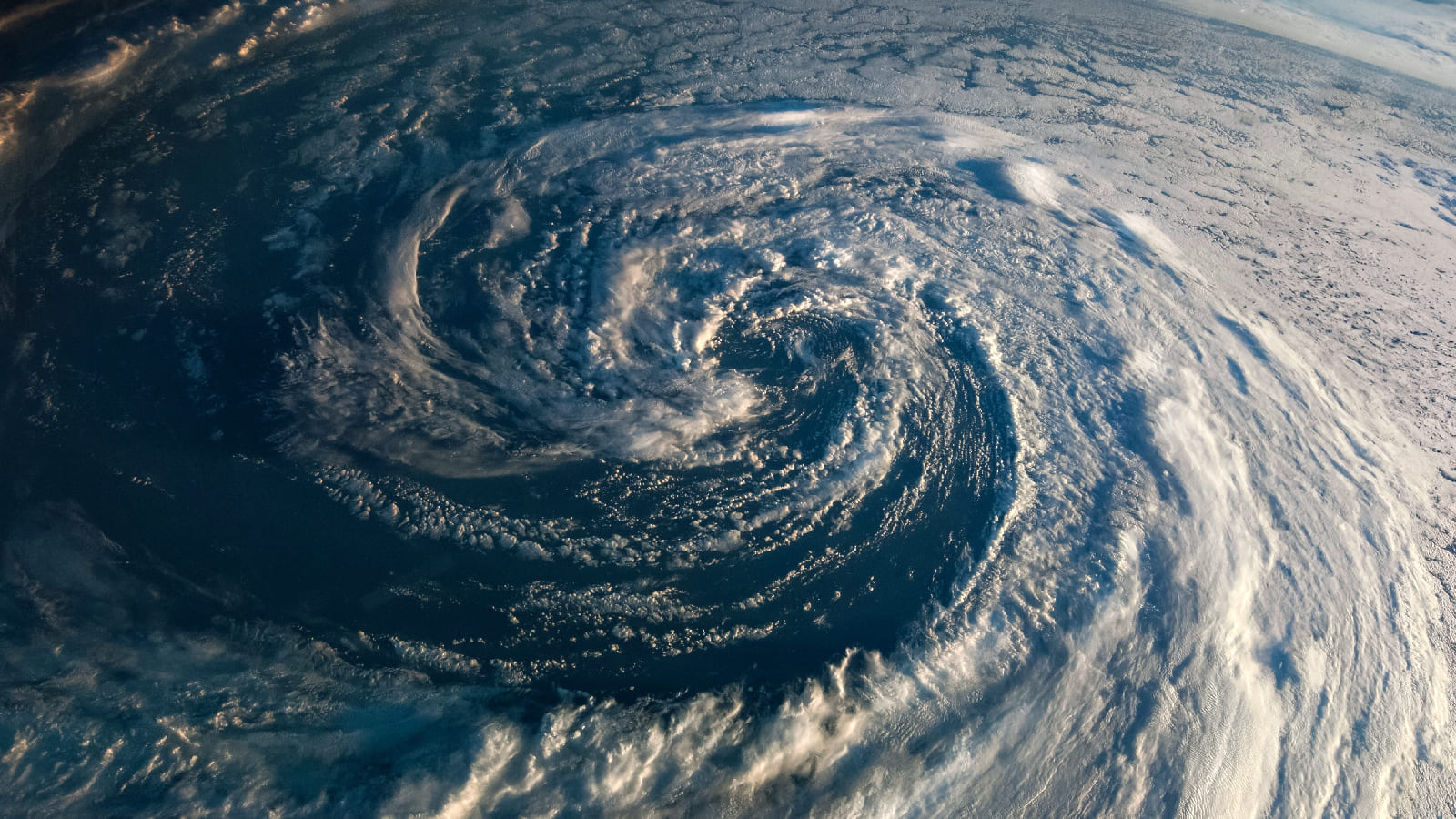

As Hurricane Season 2024 looms over coastal communities, insurers face a pivotal moment: customer relationships are no longer just about cutting checks. It’s about cutting through chaos. The companies that master proactive engagement during critical moments aren’t just processing claims 30% faster—they’re building deeper, lasting relationships. And in a world of rapidly evolving customer expectations, that’s the real victory.

Yet here’s the twist: while 40% of homeowners rush to increase coverage after disaster strikes, this urgency fades with time, leaving them vulnerable once again. So, how can insurers break this cycle of panic and complacency? The answer lies in data-driven innovation, which helps insurers keep pace with rapidly evolving customer needs long after the storm has passed.

Elevating the Customer Experience

Have you ever had to explain your issue to four different customer reps? 40% of policyholders have switched providers because of poor communication. For insurance customer experience executives, this is a wake-up call. Creating an omnichannel experience, from chatbots to in-person support, empowers customers to engage on their terms. And when disaster strikes, rapid claims processing and responsive service aren’t just important—they’re key moments that define their trust in you.

Proactive engagement doesn’t just address immediate concerns; it anticipates them. Insurers need to educate customers about their risks, maintain high levels of engagement, and prevent underinsurance in the long run. As such, user-friendly digital platforms become essential. Intuitive mobile apps, responsive websites and relevant content are no longer a luxury—they are the baseline for customer satisfaction in today’s on-demand economy.

Innovating Claims Management

Emerging technologies like AI, computer vision, and blockchain are revolutionizing claims processing, and insurance companies need to stay ahead of the curve. From automated document verification to predictive analytics, these tools streamline turnaround times and reduce fraud adding agility and efficiency to your operations.

Tailoring Coverage to Individual Needs

In an era where 70% of consumers are willing to share personal data (health, exercise, and driving habits) in exchange for lower insurance premiums, one-size-fits-all insurance is a relic of the past. Customers want policies tailored to their specific needs. The opportunity? Customizable plans with flexible limits and deductibles aligned precisely to each policyholder’s risk profile.

Usage-based models that leverage telematics data offer truly personalized premiums, helping insurers price policies more accurately and incentivize risk-reducing behaviors leading to more satisfied customers.

Fostering Proactive Engagement

Educating customers about disaster preparedness isn’t just a nice-to-have—it’s a must-do. Insurance providers who actively help policyholders mitigate risk, reduce losses and strengthen relationships. Beyond that, community involvement through partnerships with relief organizations shows that insurers genuinely care about the well-being of their policyholders.

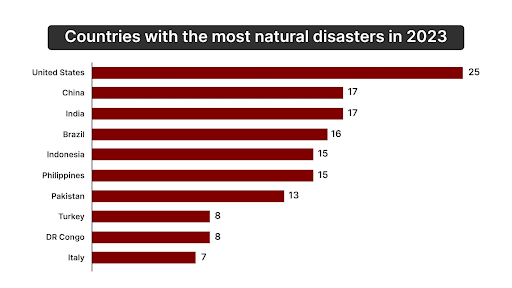

A proactive approach is especially critical in regions facing market instability due to natural disasters. As larger insurers exit high-risk markets, smaller players may step in with unsustainable premiums. Established insurers, can maintain loyalty by engaging customers directly and offering solutions that weather even the fiercest storms.

Harnessing Data for Prescient Risk Assessment

Advanced data analytics allow insurers not just to react but also predict. By analyzing historical claims data, weather trends, and emerging risk factors, you can model the impact of climate change with increasing precision. Advanced Analytics enables you to adjust coverage options, pricing models, and risk management strategies proactively—putting you ahead of the curve.

Geospatial data adds an extra layer of insight, allowing insurers to develop highly localized risk profiles. From topography to flood zones, this granular understanding enables more accurate coverage, enhancing both customer trust and profitability.

At the same time, insurers need to address the low uptake of flood insurance in high-risk areas. By leveraging data to pinpoint protection gaps, you can innovate new products and outreach programs that ensure your customers are fully covered—before the next disaster hits.

Transforming Crisis into Opportunity

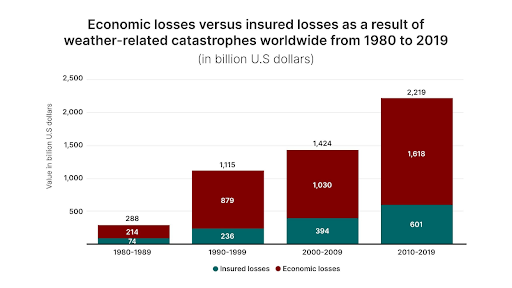

In 2023, global economic losses from natural disasters reached nearly $380 billion, largely due to severe earthquakes and storms. These staggering numbers highlight the growing financial impact of such events on economies worldwide. The companies that thrive in this new era won’t just be reacting to the next crisis – they’ll be anticipating it.

Whether it’s shifting markets or glaciers, some things are out of our hands—but your insurance strategy doesn’t have to be one of them. The question isn’t whether to transform – it’s how fast you can get there. Future-proof your operations while delivering a policyholder experience that stands the test of time.

Ready to write the next chapter in insurance innovation? Connect with our transformation experts today: Mu Sigma LinkedIn