The global financial landscape has undergone a whirlwind of transformation and modernization. From ATMs in the ’60s and the advent of online banking in the ’90s to peer-to-peer lending platforms in the mid-2000s and the onset of mobile banking apps in 2011, the financial services sector has consistently embraced technology to reshape its operations and customer interactions.

Today, we are on the verge of a new era in which the untapped potential of Artificial Intelligence (AI) is poised to push the boundaries of innovation even further. We have reached a point where AI is no longer in its experimental stage but has evolved into a force for real-world transformation, paving the way for Applied AI to step into the spotlight and take center stage.

Demystifying Applied AI: What Sets It Apart?

As revealed by McKinsey, Applied AI is a prominent technology trend unfolding today, with a substantial investment of $165 billion recorded in 2021. But what precisely constitutes Applied AI, and how is it different from conventional AI? The answer is simple.

Applied AI is a specialized domain within the realm of AI that leverages advanced AI and Machine Learning (ML) techniques to tackle real-world challenges and translate theoretical concepts into tangible solutions outside the confines of laboratories. It refers to the practical implementation of AI technologies and techniques to solve specific real-world problems. Conversely, AI is a broader field focused on developing advanced intelligent machines and systems that mimic certain aspects of human intelligence, such as learning from data, reasoning, and making predictions.

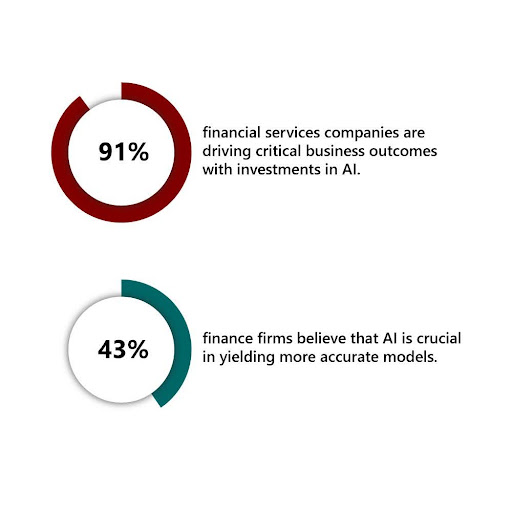

Applied AI offers remarkable accuracy and adaptability, supporting businesses with sophisticated computational abilities akin to human decision-making. It enables accurate outcome predictions, automates processes from start to finish, saves time and resources, and boosts profitability. We are already observing a significant upswing in the application of AI within the finance sector. As highlighted in a NVIDIA report, an impressive 91% of financial services companies leverage AI investments to achieve pivotal business outcomes. Notably, 43% of respondents believe that AI is pivotal in refining the accuracy of their models.

An illustrative example is JPMorgan, which plans to invest $1 billion in AI and data analytics investments in 2023. The company has already applied AI in hundreds of instances and plans to continue investing in 2024 and beyond.

Applying AI to Deliver Impact in the BFSI Sector

Although Applied AI is still in its nascent stages, a significant surge of innovation is making its mark in this field. Harnessing the power of ML, Knowledge Graphs, Natural Language Processing (NLP), Computer Vision, Predictive Analytics, and more, Applied AI has varied real-world applications that yield concrete results in finance, transcending theory and producing tangible impacts. Let’s take a look.

Delivering Personalized Customer Experience

62% of consumers expect personalization, suggesting that a company will lose their loyalty if their experience is not personalized. Using advanced ML algorithms and predictive analytics, Applied AI enables companies to gather and analyze vast amounts of customer data such as transaction histories, spending patterns, investment preferences, risk tolerances, etc., to predict potential offerings that resonate with users. For example, companies using Applied AI can analyze a customer’s risk tolerance, investment goals, and market trends to recommend stocks, bonds, or funds matching their profile.

Furthermore, integrating knowledge graphs with ML in Applied AI paints a holistic and detailed view of customer data. Knowledge graphs help address customer challenges more effectively and generate more accurate recommendations, leading to increased sales and improved customer retention.

Boosting Fraud Detection

Financial institutions harnessing the power of Applied AI can significantly speed up their fraud detection process. Applied AI helps establish patterns of typical behavior for each customer. Any deviation from these patterns can signal potentially fraudulent activity such as phishing, account takeovers, and identity theft, prompting immediate action. Using ML and anomaly detection, Applied AI can further spot discrepancies in transaction amounts, frequencies, or locations, identifying unusual patterns that might go unnoticed by traditional methods. These solutions help reduce losses, avoid business disruption, and enhance operational efficiency.

Improving Risk Assessment and Management

Risk assessment is at the core of financial decision-making. By sifting through extensive datasets encompassing historical economic trends, market variables, and global events, AI algorithms help financial institutions identify hidden patterns and relationships, enabling them to anticipate potential market shifts offering a crucial advantage in risk mitigation.

The fusion of AI with ML and Predictive Modeling enables companies to gauge the potential impact of different risk factors. For instance, finance companies can explore the consequences of interest rate changes, market fluctuations, or geopolitical events on their portfolios. These applications allow for more intelligent decisions and effective risk management strategies.

Optimizing Anti-Money Laundering (AML) Efforts

While the use of Applied AI to fight AML is still in its early stages, it carries huge potential to refine the AML procedures of financial institutions. Combining ML with advanced algorithms such as random forest, gradient boosting, deep learning, etc., enterprises can analyze extensive datasets encompassing transaction records and customer behavior to detect complex patterns of suspicious conduct and high-risk money laundering zones. An additional advantage is the adaptability of ML models, which can be continuously updated with new data, thereby enhancing the accuracy of identifying anomalies. By replacing rule- and scenario-based methods with ML models, McKinsey noted a leading financial institution could improve suspicious activity identification by up to 40% and efficiency by up to 30%.

Balancing Act: Need for AI Governance and Oversight

Integrating Applied AI in banking and financial services provides plenty of opportunities for efficiency, competitive advantage, insight, and innovation. However, many uncertainties cloud the AI landscape within the sector and demand a robust framework of governance to adhere to regulations such as GDPR, MiFID II, and KYC and practice responsible, equitable, transparent, and secure AI use.

A significant concern is the biases within AI models that discriminate against specific demographic groups. Bias is particularly significant in contexts like fair lending practices, where prejudice based on race, gender, or ethnicity is strictly prohibited. Similarly, the susceptibility of AI-driven algorithmic trading to cyberattacks and manipulation requires strict security measures to prevent data breaches and unauthorized access.

By defining clear objectives, establishing cross-functional teams, implementing robust data quality checks, maintaining clear records of AI development, conducting continuous monitoring and auditing, and providing rigorous training, the finance sector can seamlessly align with the evolving regulatory framework, steer clear of potential legal pitfalls, and thrive in this AI-driven era.

Applied AI holds massive potential in banking and financial services to streamline traditional processes and open avenues for accelerated growth, productivity, and enhanced customer experiences. By embracing the evolving landscape of Applied AI, the sector is poised to navigate complex challenges and pave the path where finance and AI converge to create lasting value for all stakeholders.